|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

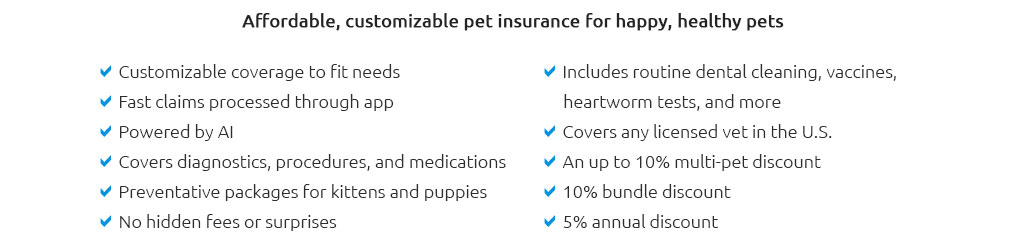

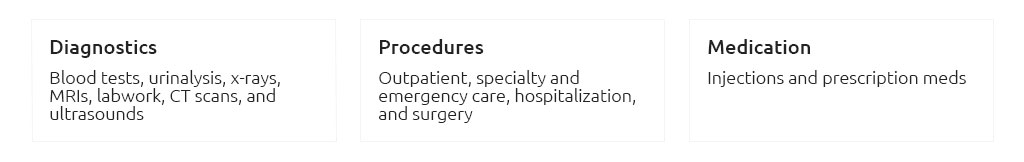

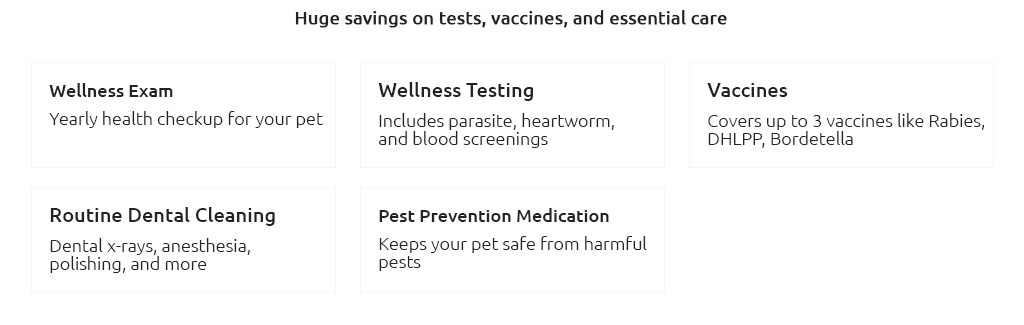

Understanding the Cost of Cat Insurance: A Monthly BreakdownIn today's world, where our feline companions are cherished members of the family, ensuring their health and well-being is a top priority for many pet owners. One way to provide peace of mind and financial security in case of unexpected veterinary expenses is through cat insurance. However, the question that often arises is, 'What does cat insurance cost per month?' Determining the monthly cost of cat insurance can be complex, as it varies based on several factors including the type of coverage, the age and breed of the cat, and the insurance provider's policies. On average, you might expect to pay anywhere from $10 to $50 per month, but this range can fluctuate significantly. Factors Influencing Cat Insurance Costs The first factor to consider is the type of coverage you choose. Basic plans typically cover accidents and illnesses but might exclude routine care such as vaccinations or dental cleanings. More comprehensive plans, which include preventive care and wellness checks, understandably come with a higher premium. Additionally, some providers offer customizable plans that allow you to select specific coverage options, further influencing the monthly cost. Age and Breed Considerations Another important aspect is the age and breed of your cat. Generally, insuring an older cat costs more due to the increased likelihood of health issues, whereas younger cats might be less expensive to insure. Certain breeds, known for specific health problems, may also incur higher insurance rates. For instance, purebred cats might be more expensive to insure compared to mixed breeds because of their genetic predispositions to certain conditions. Common Mistakes to Avoid When considering cat insurance, there are common pitfalls that pet owners should avoid. One mistake is neglecting to read the fine print; policy exclusions can lead to unexpected out-of-pocket expenses. It's crucial to understand what is and isn't covered under your chosen plan. Another mistake is opting for the cheapest plan available without considering the actual needs of your pet. While saving money upfront is appealing, inadequate coverage could lead to significant expenses down the road. Moreover, some pet owners might overestimate their ability to pay for unexpected veterinary bills out of pocket, underestimating the financial strain that a serious illness or accident can impose. Insurance serves as a financial buffer, and selecting a policy that aligns with your financial situation and your cat's healthcare needs is essential. Conclusion In conclusion, while the cost of cat insurance per month is an important factor, it should not be the sole consideration when choosing a policy. Understanding the coverage details, being aware of potential pitfalls, and selecting a plan that balances cost with comprehensive care are crucial steps in ensuring your cat's health and your peace of mind. What affects the cost of cat insurance? The cost is influenced by factors such as the type of coverage, age and breed of the cat, and the insurance provider. Can I customize my cat insurance plan? Yes, many providers offer customizable plans allowing you to select specific coverage options. Is it worth getting comprehensive coverage? Comprehensive coverage can be beneficial if it aligns with your cat’s healthcare needs and your financial situation. What common mistakes should I avoid with cat insurance? Avoid neglecting the fine print, choosing inadequate coverage, and underestimating potential veterinary costs. https://www.worthinsurance.com/data-labs/average-pet-insurance-cost-for-individuals-families

Average Cost of Cat Insurance by Cat Breed Per Month - Abyssinian: $21 - Bengal: $21 - Bombar: $20 - British Shorthair: $21 - Devon Rex: $20 - Domestic Shorthair: $17 ... https://www.nerdwallet.com/article/insurance/cost-of-pet-insurance

. The average cost of accident and illness coverage for cats is $383 per year, or about $32 a month. For an accident- ... https://www.cnbc.com/select/pet-insurance-cost/

Cats cost slightly less: The average feline costs between $180 and $870 per year with emergency veterinary care adding up to $1,615. Fortunately, a good pet ...

|