|

cat insurance cost per month made simple and safeYou want a clear number, a quick path, and zero confusion. Here's how to decide with confidence while keeping things safe and simple. Quick monthly ballparkFor accident + illness plans, many cats fall roughly in the $15 - $40 per month range. Accident-only can drop under $10. Adding wellness or higher limits can push totals toward $40 - $70. These are estimates; your zip code and choices shift the final number. What changes the price- Age: Kittens cost less; seniors cost more.

- Breed and health history: Some hereditary risks increase premiums.

- Location: Vet costs vary by region.

- Covers and caps: Higher annual limits and extra add-ons raise the monthly.

- Deductible and reimbursement: Higher deductible or lower reimbursement usually lowers the monthly.

- Waiting periods and exclusions: Pre-existing issues aren't covered, which affects what you're actually paying for.

Estimate in 3 minutes- Note essentials: age, breed, indoor/outdoor, your zip, any known conditions.

- Pick a baseline: $5,000 annual limit, $250 - $500 deductible, 70 - 80% reimbursement.

- Get a quote, then nudge settings: raise the deductible first if you need to trim the monthly.

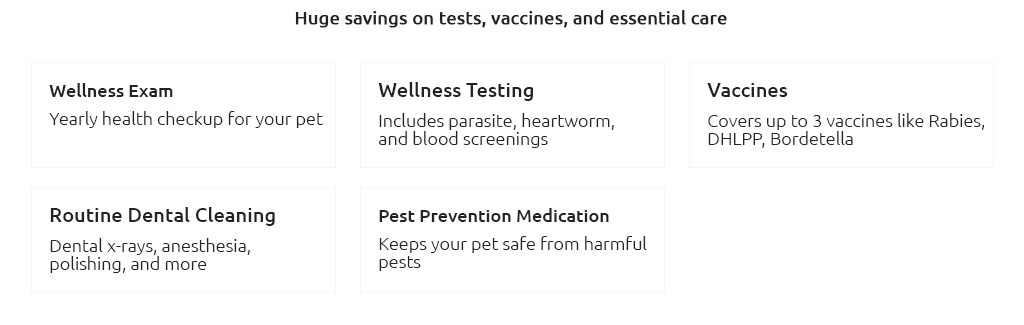

- Decide on wellness only if you truly use routine care; skip it if you prefer paying those expenses directly.

- Check waiting periods so the timing fits your plans.

Safety-first choices, simplified- Choose a deductible you can pay today without stress.

- Aim for reimbursement that avoids bill shock (80% is a simple starting point).

- Avoid very low annual limits if your clinic's estimates for surgery run higher.

- Confirm exam fees are covered; some plans exclude them.

- Know how claims are paid: direct pay to vet or reimburse you later.

Real-world moment: In the lobby at Maple Grove Vet, I okayed a $28/month plan for a 2-year-old rescue after hearing that an X-ray can run a few hundred dollars; a week later a sprained paw visit was mostly reimbursed, which felt like a steadying hand during a wobbly day. Ways to lower the monthly- Raise the deductible gradually (e.g., $250 → $500) while keeping an emergency buffer.

- Try 70 - 80% reimbursement instead of 90% if premiums jump too high.

- Pick a practical annual limit (e.g., $5k - $10k) instead of unlimited if it meaningfully cuts cost.

- Skip wellness if you don't routinely use it; pay routine visits out of pocket.

- Ask about multi-pet or annual-pay discounts.

Coverage details that matter- Annual limit: Max the plan pays each year.

- Deductible: Per year or per condition; per-year is simpler for most owners.

- Reimbursement: 70 - 90% commonly; ensure it's after deductible, not before.

- Waiting periods: Accidents may be short; illnesses and knees often longer.

- Exclusions: Pre-existing conditions and some hereditary issues may not be covered.

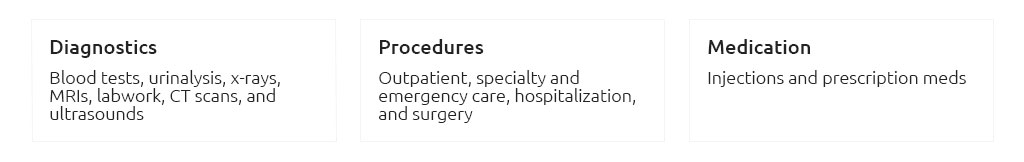

- Add-ons: Dental illness, rehab, behavioral - only add what you'll use.

Simple decision path- Set a safety budget: a monthly number you barely notice (say $25 - $35).

- Choose accident + illness (default) or accident-only (interim safety net).

- Pick a deductible you could pay same day in an emergency.

- Select 80% reimbursement as a clear middle ground.

- Match annual limit to local procedure costs (often $5k+).

- Read exclusions and waiting periods; confirm exam fee coverage.

- Grab two quotes; choose the one you understand at a glance.

Fast examples (estimates vary)- Kitten, 6 months, $5k limit, $250 deductible, 80%: about $15 - $25/mo.

- Adult, 3 years indoor, $5k limit, $500 deductible, 80%: about $20 - $35/mo.

- Senior, 10 years, higher limit, $500 deductible, 70 - 80%: about $40 - $70/mo.

If the number still feels high, try accident-only for now while you build a small emergency fund; upgrading later is straightforward if your cat stays healthy. Choose clear terms, a price you hardly feel, and coverage that lets you act fast in a scare - then review at renewal and adjust as life shifts.

|

|